Saddleback ski area might get back in business with another new prospective buyer

The purchase price was not disclosed. The ski area has been closed since 2015.

From the Portland Press Herald

An investment firm from Boston has made an offer to buy Saddleback Mountain, stating that they’ll invest between $25 million to $30 million after the sale to help restart the Rageley ski resort, now closed for four years.

The property is owned by the Berry family. The details of what Arctaris Impact Fund is offering to the Berry family has been disclosed in an email to the owners of Saddleback condos. The email was sent by Andy Shepard, CEO of the Outdoors Sports Institute and Tom Federle, a Portland attorney who have been working with Arctaris trying to purchase the ski area.

Saddleback was Maine’s third largest ski resort offering lots of local jobs and drawing thousands of tourists each winter while it was opened.

Shepard would not confirm the terms and conditions of the purchase – only that the $500 million investment group wants to buy the ski mountain and can afford it. The purchase price was not disclosed.

“Tom Federle and I have been quietly trying to find a buyer for the mountain for the last four years and connected with Arctaris last fall. We have been very impressed with their commitment and capacity to not only buy the mountain but doing so with a long-term view to make the mountain successful,” said Shepard, the former CEO of the Maine Winter Sports Center, in an email Friday. “Arctaris is the real deal and I’m hopeful for the Berry family and for the people of western Maine that we can get a deal done.”

Federle owns a condo in Saddleback. Shepard said his interest in the deal is in “preserving one of Maine’s most remarkable ski mountains and the role it plays in the economy of the region, an interest shared by Tom.”

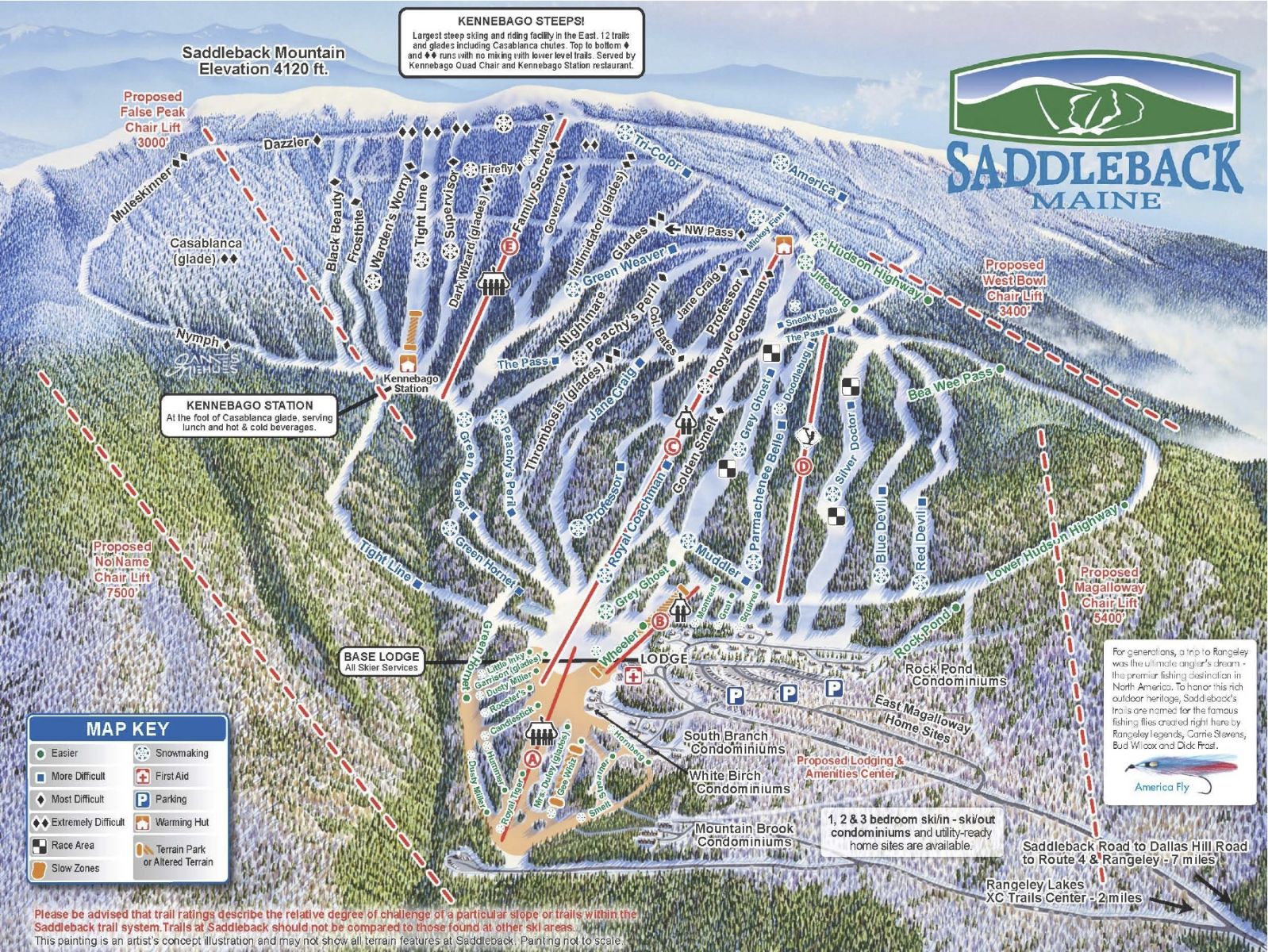

Saddleback, owned by Irene and Bill Berry of Farmington, has been on the market since July 2015. The ski mountain – one of the largest in Maine with an elevation of 4,120 feet – has not been open since the 2014-2015 season.

Continue reading “Saddleback ski area might get back in business with another new prospective buyer”

You must be logged in to post a comment.